Financing the SME Sector

HLB Corporate Services (Mauritius) Ltd

Small and Medium Enterprises (SMEs) have always been at the centre of attention as a result of the challenges they face in their quest for finance. The gap between the financing options available to SMEs and the finance that they could productively use is often known as the ‘funding or financing gap’. Being an engine of growth for the whole of our economy (44% of employment, 34.9% of Gross Value Added as of 2020*), it is important for the relevant stakeholders to understand and explore financing opportunities available to help the SME sector achieve its optimum growth potential.

Bank loans are one of the most common forms of financing that SMEs look for. However, financing for these SMEs is available in very limited options such as a bank overdraft or a bank loan which is capped at a restricted amount with the need of providing collaterals and charges as security. There are very few financial institutions (mostly government owned) which provide funding without restrictive capping and without collaterals to the SME sector. As a result, this causes the growth and expansion of the SME sector to stagnate. This, in turn, slows and diminishes the optimum contribution potential that can be brought by this sector to the economic growth of the island.

Although the supply of funds is limited and competitive when it comes to SME financing, there are several alternative sources that can be considered and used simultaneously by SMEs to achieve their objectives.

These include:

- Crowdfunding

Crowdfunding is a route which enables companies to raise money through an online platform to finance projects and their businesses. It allows fundraisers to procure funding from a large number of people without security. The bigger challenge remains the reputational damage incurred by the SME in case of default. The rate of interest charged by Fundkiss, Mauritius' first licensed crowdlending platform, ranges between 12%-13% depending on the risk profile of the borrower and the duration of the loan.

- Angel Investment

A business angel is a wealthy individual who is willing to take the risk of investing in SMEs. One limitation of this method of financing is that these individuals are not common and are very often quite particular about what they are prepared to invest in. Once a business angel is interested they can become very useful to the SME, as they will often have great business acumen themselves and are likely to have many useful contacts.

- Trade credit

SMEs, like any other company, can take credit from their suppliers. However, this type of financing is only short-term and, if their suppliers identified them as a potentially risky SME, the ability to extend the credit period may be limited.

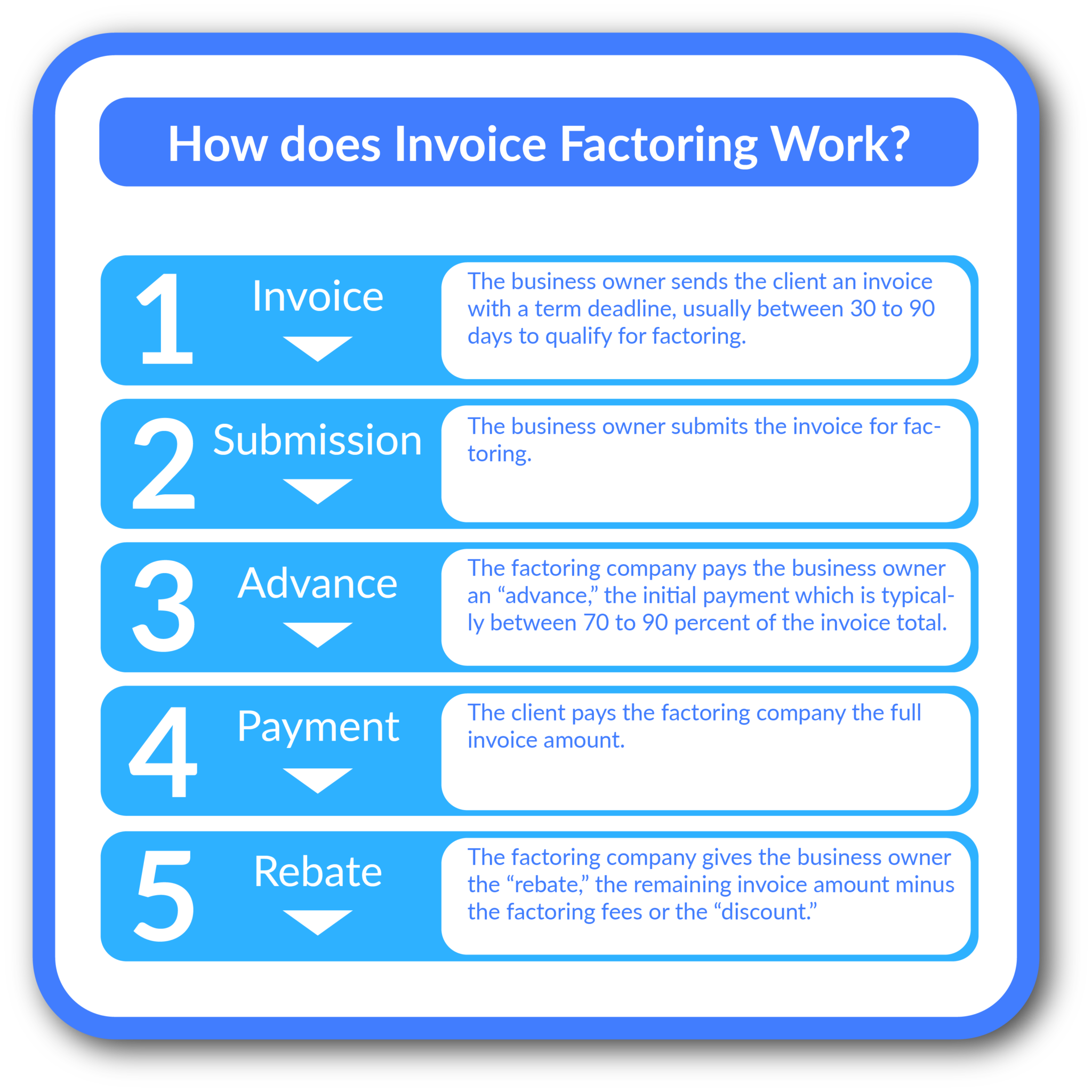

- Factoring and invoice discounting

Factoring is a type of debtor finance which involves selling an organisation’s accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs. One of the advantages of these sources of finance is that they grow as an SME grows. Indeed, when an SME grows, its receivables will grow and hence the amount they can borrow will follow the same trend. In Mauritius, these sources of finance allow a company to raise funding up to 90% of their invoicing from a factoring institution against its receivables. This type of financing is usually short-term and often expensive due to the high interest rate which turns around 2.9%.

- Leasing

Leasing is a very useful type of finance as it avoids an SME the need to raise the capital cost upfront. In Mauritius, the Industrial Finance Corporation of Mauritius (IFCM), a government-owned organisation set up to support enterprises financially, can advance up to MUR 50 M at an interest rate of 2.5% in terms of leasing facilities under the Leasing Equipment Modernisation Scheme (LEMS). However, the SME may have to make a deposit or an advance payment which it may not have. Also leasing may be more expensive in the long run than buying the assets outright.

- Export Credit Insurance

Export Credit Insurance is aimed at exporting companies wishing to benefit from financial protection against customer risk in the context of their commercial activities abroad. It is a form of insurance that protects an exporter of products and services against the risk of non-payment by a foreign buyer. In Mauritius, a refund of 50% of the credit insurance premium is provided to organisations including SMEs under the Export Credit Insurance Scheme (managed by the Economic Development Board), subject to a ceiling equivalent to a maximum of 0.5% of declared insurable turnover which is paid either directly to the insurer or through the export credit insurance provider until June 2023. The objective was to encourage the SMEs to take an insurance cover to secure trading and hence, boost up exports from Mauritius.

- Friends/Family Financing

This is a very good and cheaper source of finance as friends and family members may be willing to accept a lower return than other investors as their motivation to invest is not purely financial. However, the key limitation of this type of financing is that the fund which can be raised from friends and family is very limited.

The challenges faced by SMEs for financing have decreased over the years with the advent of innovative and dynamic sources of finance. However, some barriers still exist which are caused by the inherent risk associated with an SME in terms of its size, lack of management experience, lack of collaterals and proven track record among others.

The last National Budget has given a new definition of SMEs which will now include entities which reckon an annual turnover of up to MUR 100 million. This will increase the demand for SME Finance, and it is high time for SMEs to consider the alternative finance routes spelt out above in order to thrive their way in the competitive context we are now operating in.

*Provisional Figures from Statistics Mauritius